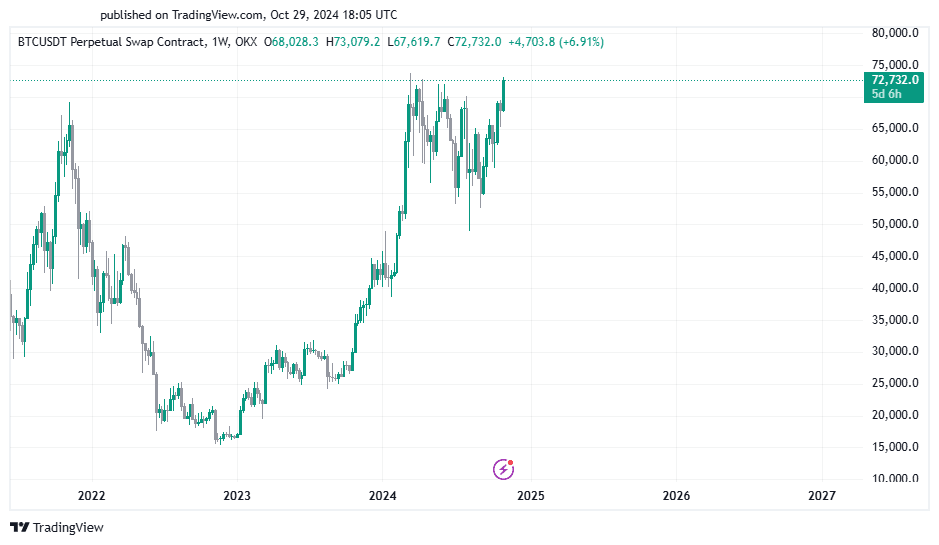

After months of stagnation, Bitcoin has surged past the $70,000 threshold, a pivotal move rekindling investor optimism. This “Uptober” finale paves the way for potential robust price activity as the cryptocurrency market embarks upon November—historically a lucrative period for Bitcoin.

Analyzing Bitcoin’s Prospects in November

Renowned crypto analyst Ali Martinez has outlined his insights regarding Bitcoin’s trajectory in an X post, highlighting the digital asset’s recurrent bullish performance in November. With historical data sourced from Coinglass, Martinez points out Bitcoin’s record of securing positive monthly returns in November on seven occasions since 2013, underpinning his optimism for a promising market ahead.

Given Bitcoin’s recent breach of the $70,000 resistance level—a barrier it has long grappled with—the likelihood of a rally toward its all-time high (ATH) of $73,000 and beyond grows. Martinez anticipates an ascent potentially reaching $78,000 as the next significant threshold.

There remains a strong prospect that Bitcoin may achieve or even exceed its ATH before November 5, the date set for the U.S. presidential election. With Bitcoin trailing its ATH by merely 3%, experts, including those from Standard Chartered, foresee a new record before the election concludes.

Catalysts Fueling Bitcoin’s Rally

The recent upsurge in Bitcoin’s price can be attributed to multiple factors, primarily substantial buying activity on Binance, as noted by Cryptoquant, a market analytics platform. Additionally, Spot Bitcoin ETFs have played an instrumental role, evidenced by their ongoing inflows—amassing $479.35 million as of October 29, surpassing the previous week’s total of $402 million.

The demand for these ETFs is noteworthy, as their earlier contributions propelled Bitcoin to its ATH of $73,000 in March. In parallel, the impending U.S. election introduces a pivotal dynamic; with pro-crypto candidate Donald Trump currently leading in polls, investor sentiment appears optimistic.

Historically, post-election periods have proven favorable for Bitcoin’s performance, as seen in the ATH surges following both the 2016 and 2020 elections. The coming month could mirror this pattern, positioning Bitcoin for unprecedented gains as market dynamics converge.